Before the Diagnosis: Dementia’s Early Financial Toll - an AgeLab and AARP Symposium

by Adam Felts

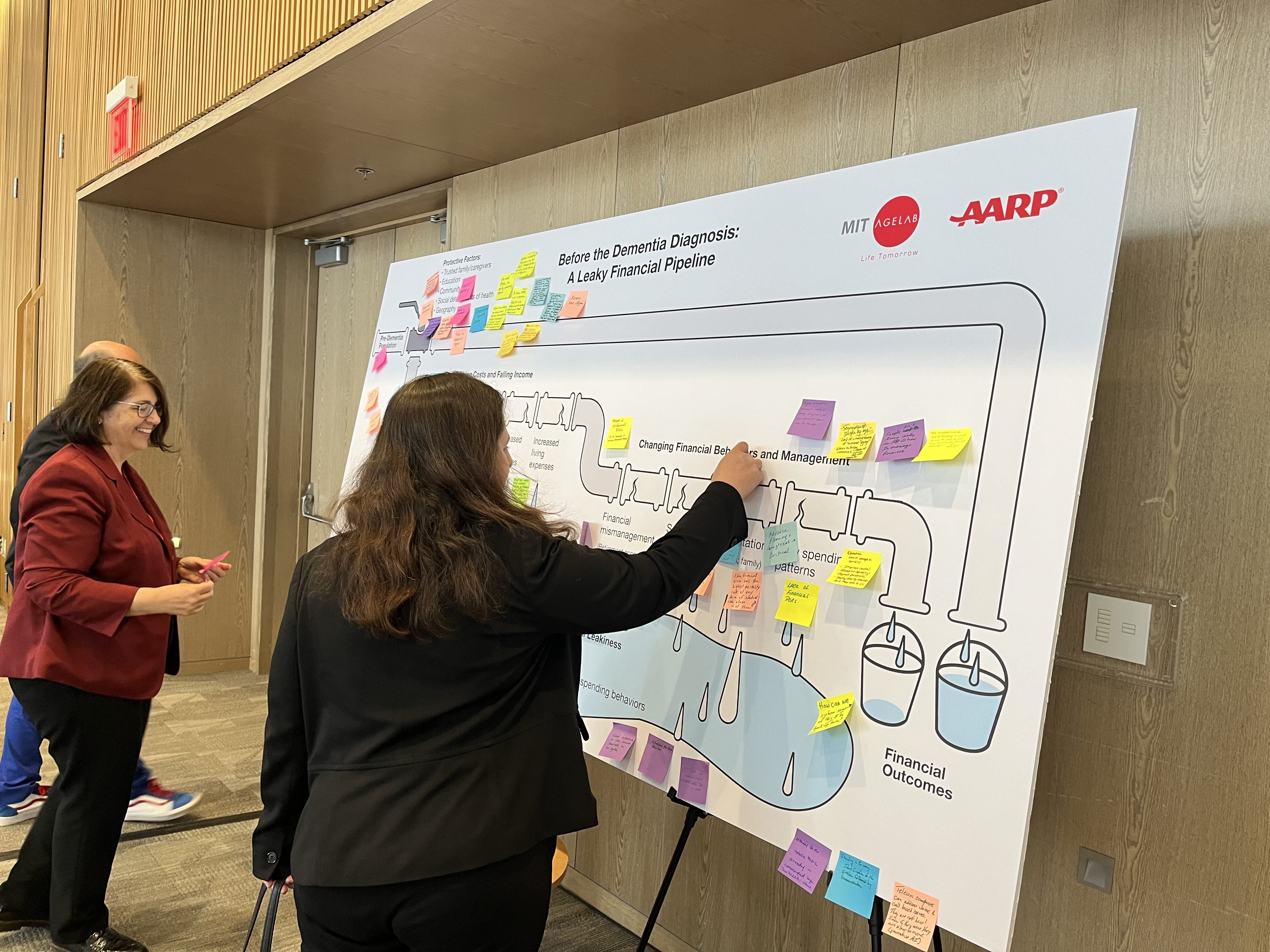

The MIT AgeLab and AARP held a daylong event on April 10, 2024, to discuss the relationship between brain health and financial wellbeing. The symposium, titled “Before the Diagnosis: Dementia’s Early Financial Toll,” featured testimonials from families affected by dementia-related financial loss, practitioners and experts focused on the different aspects of how dementia can impact finances, and academics on the cutting edge of the topic who shared their findings from recent research, which revealed how early in the process of cognitive decline that financial decision-making can be affected.

Debra Whitman, Executive Vice President and Chief Public Policy Officer at AARP, gave opening remarks for the symposium. “It's no secret that the financial difficulties of dementia don’t start on the day of diagnosis,” she said. “But 6 or 8 years before? I thought: What is going on here? And what can we do to prevent these losses and the suffering that goes with them?”

Lindsay Kobayashi, Assistant Professor of Epidemiology at the University of Michigan, discussed the two-way relationship between negative financial shocks and cognitive loss in later life, as well as differences between countries – with residents of the United States experiencing especially high negative cognitive outcomes in the wake of financial shocks. Jing Li, Assistant Professor of Health Economics of the University of Washington, demonstrated the association between households’ financial losses, with a median loss of over $100,000 in net worth, that occur in the eight years leading up to a dementia diagnosis. Lauren Hersch Nicholas, Associate Professor in Geriatrics at the University of Colorado, disclosed the surprising finding that changes in financial behavior can appear up to six years prior to a formal dementia diagnosis, putting financial professionals on the front lines of identifying cognitive decline in clients and mitigating potentially harmful financial decision-making.

Later sessions focused on the practical implications of these research findings. One panel featuring Brent Forester of Tufts Medical Center, Mike Petty of Edward Jones, and Tamara Smith of Humana discussed how the combination of income loss and soaring healthcare and other costs – often before the dementia diagnosis even occurs – puts intense financial pressure on older adults dealing with cognitive impairment. A session that included Brian Forbes of Transamerica, Liz Loewy of EverSafe, and Lindsay Chura of AARP considered the risks of financial fraud, exploitation, and mismanagement that are often heightened in the years both following and leading up to a dementia diagnosis. The final panel of the day focused on pragmatic interventions, levers, and solutions to aid in the financial wellbeing of people suffering from dementia--and any systemic obstacles that must be addressed first, with contributions from Jilenne Gunther of AARP’s BankSafe, Duke Han of the University of Southern California, Nina Kohn of Syracuse Law School, and Kelly O’Brien of UsAgainstAlzheimer’s.

Joseph Coughlin, Director of the MIT AgeLab, closed the session with a call to continue efforts to address the financial vulnerabilities of people with cognitive decline. “This topic is too big and too important to say it’s a policy issue or business issue alone,” said Dr. Coughlin, echoing the event’s emphasis on bringing together stakeholders from across sectors to learn and build solutions from the latest research.